- World’s 2nd Largest Art Museum Going NFT - July 30, 2021

- Finance a Film via Blockchain - July 1, 2021

- 40% of New Fintech Firms in Hong Kong Use Blockchain - June 8, 2020

For all you Bitcoin and cryptocurrency fans, I wanted to share some insights about ‘Bitcoin halving’, what is it and how can it or it can’t affect bitcoin’s price.

If you’re on social media, you may have noticed there is a lot of buzz and chit-chat going around this topic of ‘Bitcoin halving’. Some believe that the upcoming Bitcoin halving event will trigger a rapid spike in price, and may even make a price run up like the 2017 Bitcoin upswing that happened. Is this possible?

Warren Buffet has put on a positive cap now (after years of shooting at Bitcoin’s worthiness. In his recent proclamation, Buffet said Bitcoin may surge to USD300,000 after the halving.

Possible? Impossible? Let’s see…

First, please mark this important bitcoin halving date in your calendar: May 11, 2020, 11:00 PM GMT+8 (Note: This date may change slightly but it’s going to be during this period.)

With the halving just 17 days away, it is important for us to gain a thorough insight about this topic before making any decisions. One things for sure. It doesn’t mean if the supply of bitcoin is down, that the price will spike! Remember, the crypto community at large has already taken the Bitcoin halving into account months prior to the upcoming event.

First let’s understand precisely what is the meaning of ‘halving’.

‘Bitcoin Halving’ Meaning

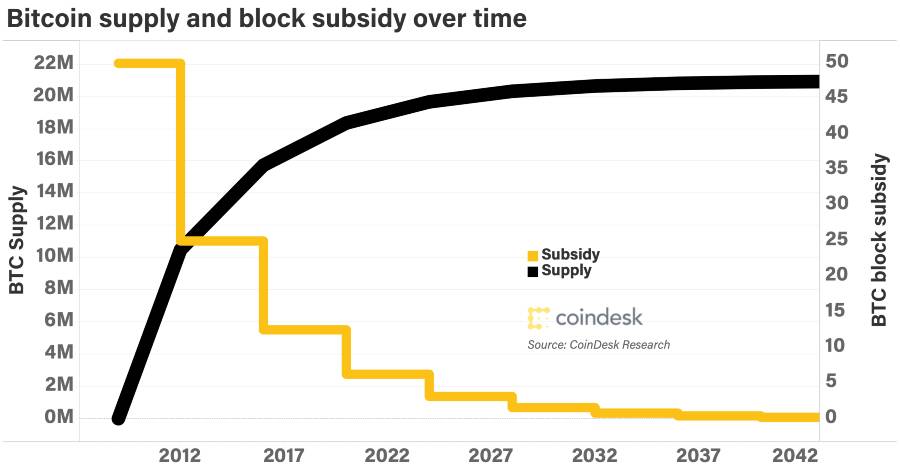

After every 210,000 blocks, Bitcoin goes through a process called halving. This mechanism was integrated into the protocol by Satoshi Nakamoto himself. After a protocol goes through halving, it cuts the supply of new Bitcoins into half, halving the miner’s block production rewards, as well.

The Bitcoin protocol cuts the bitcoin block reward in half. Every time a Bitcoin halving occurs (one in every 4-years), miners start to receive fifty percent (50%) fewer Bitcoins for verifying transactions.

You can see the effect of the halving process in the chart below.

The Bitcoin network is a non-inflationary monetary system, in the sense that its supply is fixed. Only 21 million BTC will ever be generated in existence. For now, the supply is a little above 18 million.

Bitcoins are created through a process called mining, where miners solve a puzzle using specialized hardware. This process occurs roughly every ten minutes.

Once the puzzle is solved, new bitcoins enter circulation and are rewarded to the miners that solved the puzzle first. But the rewards are not fixed. Every 210,000 blocks mined, or approximately every four years, the Bitcoin rewards are cut in half.

‘Halving’ Why Is It Important?

The main reason why the BTC halving matters is that it changes the emission rate of the currency, which directly alters the balance of supply and demand.

In other words, the amount of bitcoins entering the economy decreases while the demand, at least in theory, remains the same. Many believe that this sudden shrinkage in supply will push Bitcoin’s price higher.

However, many notable individuals don’t believe that this significant event is that cut-and-dried. There are several variables that need to be taken into account. And as with anything in crypto that concerns price, heated debates and grand predictions are expected to collide.

So how will the halving affect BTC price? There are various aspects to consider.

So, How Did Past ‘Halvings’ Do?

The best way to have some idea to know what effects can take place during the upcoming Bitcoin halving is by knowing what happened in the past halvings. It goes without saying that this isn’t the first Bitcoin halving event. For this reason, a great indicator for predicting the next halving might be historical charts.

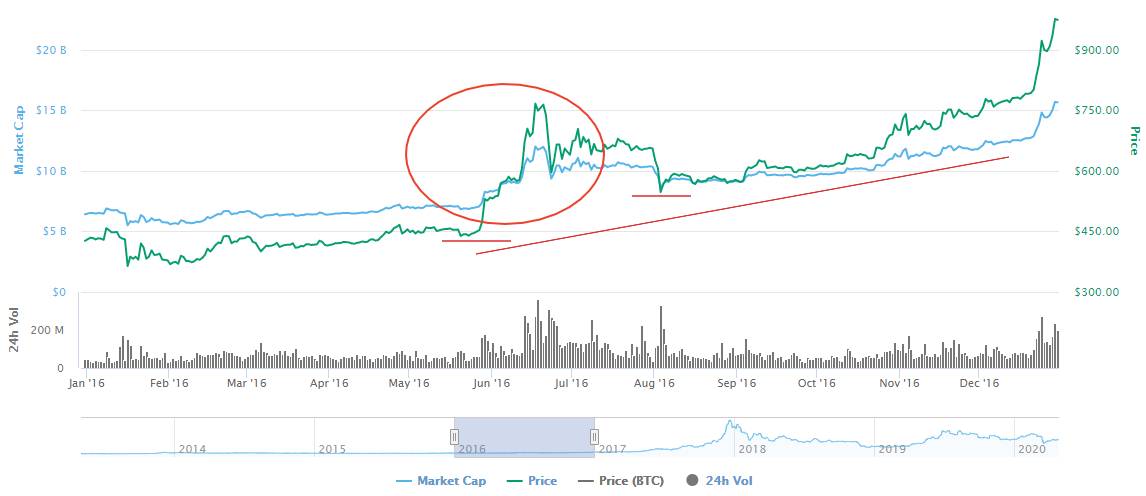

The previous halving of the Bitcoin network took place in July 2016.

So, from the chart above, you can see during the Bitcoin halving event in 2016, the price spiked from $438 to $766 in less than a month (May 20 – June 17, 2016).

Bitcoin held steady for about 11 months before its meteoric rise that peaked at $1,100 in November 2017.

As you can see, Bitcoin halvings never corresponded with an immediate upswing in price. Based on the historic charts, we can sum up that Bitcoin has a high probability of reaching unprecedented heights about a year after every halving. Does this then mean, Bitcoin would rally again sometime in May 2021?

Hmm…Not so fast.

Before 2016, the crypto space was very ‘underground’. There were only a few major marketplaces to buy or trade Bitcoin. This might have caused the slow uptrend of Bitcoin’s price, instead of limited demand.

From A Miners Perspective

Miners play an essential role in running the Bitcoin blockchain. As such, they are one of the most affected entities in the space. Why? Bitcoin rewards are their lifeblood. And when you know your lifeblood is gonna be cut in half at a predetermined date, you’d most likely prepare for it.

Miners tend to sell a huge chunk of their Bitcoin months prior to the halving in order to have enough cash to keep their business going many months after the event. This serves as a hedge in case Bitcoin does not pump right away. After all, if the rewards halve while the price remains the same, their revenue will suffer.

The main concern for miners is the break even price. Basically, a break even price is the price Bitcoin needs to maintain in order for miners to cover the costs of operation. Any lower and they’ll be losing money.

The estimated break even price for BTC after the 2020 halving would be around $12,000-$15,000, according to John Todaro, Tradeblock’s head of research.

If that were true, Bitcoin will need to double its April 2020 price for miners to run without losing money. Small mining facilities are the most vulnerable since they don’t have backup funds to stay afloat in case Bitcoin mining becomes unprofitable.

But then again, new upgrades in ASIC hardware might enable miners to generate more bitcoins at lower electricity costs, which could substantially drop the break even price.

Will COVID-19 Affect The Halving?

Perhaps this is the question right now on everybody’s mind. How will the halving event be affected by the COVID-19 pandemic?

The COVID-19 pandemic may be a black swan event since it takes the already complicated situation to a whole different level.

From what I can tell, it seems that the virus may have more of an impact on the supply chain of mining equipment than the actual price of Bitcoin itself. The pandemic has made it challenging to assemble and manufacture mining components, as well as distribute them across the world.

Despite having slight correlations with traditional markets like stocks and gold ETFs, it appears that Bitcoin has a mind of its own. It currently doesn’t have an inverse correlation with traditional markets, either. Although many Bitcoin proponents try to push that idea.

Bitcoin simply moves eerily as it always had. Whales and leverages traders might actually have more influence on its price than the virus itself.

In Conclusion

To be honest, there is no clear view of what could happen after the halving.

Several conflicting theories from industry participants would prove that there are too many variables to predict Bitcoin’s future. And with the pandemic causing chaos everywhere, the future becomes even more unpredictable. If history were to repeat itself, then we could see an upsurge in about 10-12 months. If the break even price for miners are your basis, then Bitcoin could skyrocket a lot quicker.

What I do know is that Bitcoin is here to stay, at least for a long while. The price of Bitcoin it will indefinitely continue to swing, upwards and downwards. It always has and always will, so long as there is demand and supply in the market.

Anyway, here’s some advise for new comers looking hungrily at Bitcoin: Stay vigilant. Observe the price charts and like what Evan said, ” prepare for the worst”.