What’s with Ethereum’s latest hard fork titled EIP-1559? How will it affect ‘gas prices’? Read this post if you want to get a clearer understanding on the repercussions of Ethereum’s latest London upgrade (eip 1559) targeted to be released on Aug 4, 2021.

When Ethereum was first introduced by Vitalik Buterin back in July 30, 2015, the core development team and miners already knew they were going to face a very big challenge because Ethereum is simply not ready for mass adoption.

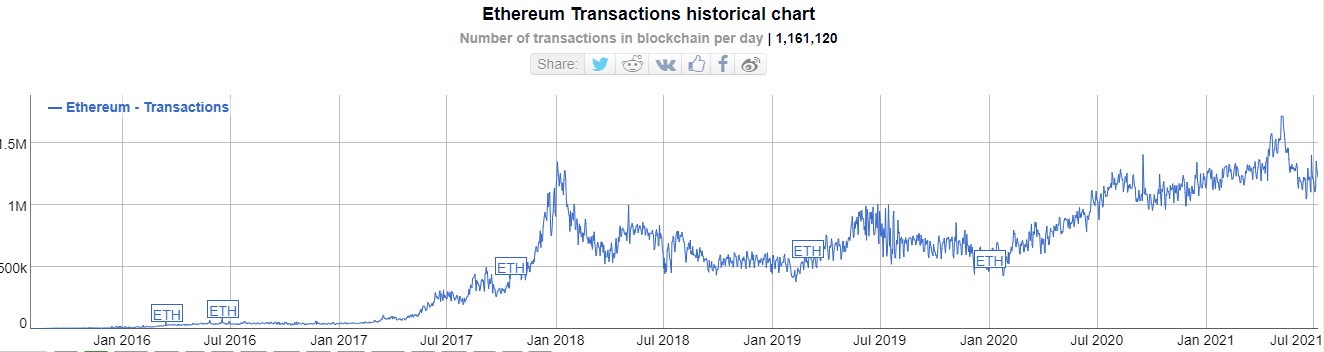

If we see what’s happening today, with the rise in DeFi (Decentralized Finance), DApps (Decentralized Applications) and the increase in Eth crypto trades by investors and not to forget the cost of using any stablecoins running on ERC-20, it has caused a major shift and an increase in Ethereum transactions, gas fees, transaction costs as well rising network congestion.

In this post, I will try to give you a deeper glance of what is EIP-1559 from a technical perspective and how will this London upgrade, ( will impact overall gas fees, or not.

So, what Is EIP-1559?

EIP-1559 or ‘London Upgrade’ (apparently named after the 2nd annual Ethereum developer conference in 2015) is a code-level improvement proposal.

If you take a closer look at the fee breakdown for Eth transactions, you will realize, fees are paid to miners. Not just one-fee, miners also receive a block reward of 2 ETH per block. Then they also receive something called ‘uncle rewards’.

The current gas price of ETH also includes something called ‘first-price auction’. It’s more like a bidding system where a user can bid a set amount to pay to the miner who is willing to process his or her transaction first and the others who cannot bid as high will have to wait. EIP-1559 supposedly will take this ‘first-price auction’ out.

The base fee will be thrown out, but a tip and the block reward will still be there for the miners to be rewarded. Remember, the current consensus mechanism of Ethereum is still relying on “Proof of Work” (PoW).

Which means miners (nodes) who support the Ethereum blockchain need to be incentivized or else many will simply abandon their efforts and move to other PoW based blockchains.

Gas price will become cheaper, right?

Nope! It will not. Why? Because this is not why EIP-1559 improvement proposal is intended to achieve in the first place. Well, with that said, technically, there may be some savings but this is conditional.

Let me explain.

Assuming we can predict accurately what the gas price would be during peak and off-peak times (network congestion) and lets assume users will now safe money and not overpay for gas fees. But when EIP-1559 is rolled out, the base fee may increase or decrease by up to 12.5%.

So long as the blocks holding the Eth transactions are 50% or more full, the base fee will be the same. 100% full and the base fee increases by 12.5%. Zero percent full and the base fee will decrease by 12.5%.

Fee based on Block Demand becomes more transparent

You bet! Up to now, users have always been in the dark about what constitutes their transaction fees. EIP-1559 will make fees based on block demand, highly transparent. Great news for users.

Not only that, users using wallets like MetaMask, will also have the option to select ‘low’, ‘medium’ or ‘high’ all depending on the previous block’s estimate use.

Will Etherscan reflect paid tips?

Nope! And this is something that I personally am not too happy about.

Why?

If I understood the EIP-1559 paper correctly, the ‘tip’ users are going to pay will be auto adjusted as part of the ‘gas fee’. Of course you can still edit the gas fee whether you want to pay more or less tip (called “priority fee”) is up to you but it will not show the breakdowns entirely.

Weird right?! (Hahaha…that’s what I thought so.)

London Hard Fork release schedule

| Network | Block Number | Launch Date | Status |

| Ropsten | 10499401 | June 24,2021 | Completed |

| Goerli | 5062605 | June 30,2021 | Completed |

| Rinkeby | 8897988 | July 7,2021 | Completed |

| Mainnet | 12,965,000 | Aug 4, 2021 | On the way |

According to Tim Beiko (Ethereum’s Core Developer), the mainnet launch will occur at block 12965000.

Which means the estimated date for the upgrade is expected to hit on August 4. The testnets have all been deployed successfully on all 3 major testnets.

What are miners doing to prepare for EIP-1559?

Upgrading their client versions.

Or else their nodes will not be compatible with the London upgrade.

Below you can find all the versions which support London upgrade. These are mainly for test Ethereum networks.

| Client | Version | Download Link |

| GETH | 1.10.4 | Download |

| Nethermind | 1.10.73 | Download |

| Erigon | 2021.06.04-alpha | Download |

| Besu | 21.7.0-RC1 | Download |

| Parity | 3.3.0-RC2 | Download |

| Ethereum | JS VM 5.4.1 | Download |

Are there any risks?

Any upgrades or forks have risks associated with it.

One things for sure. We will definitely see a lot of transaction fees get burned. And the side effect of this is, it will effect the overall supply of Ethereum over time.

When I was writing this post, I wanted to check how much fees has already been burnt and I stumbled upon a cool website which shows 89,148 has already been burned on the testnets. In dollar sense, that’s approximately $185M million US dollars worth.

Rather an expensive burning, wouldn’t you agree?!

Perhaps you are wondering, what will happen when Ethereum moves from Proof of Work consensus to PoS (likely in middle of 2022)? My guess – extreme deflation.

The way I see it, all these improvement proposals are just temporary measures. The real deal is when Ethereum 2.0 goes live. When Ethereum Version 2 is launched, it will immediately push up transaction capabilities from 15 transactions to 100,000 transactions per second.

That’s what I call, “truly getting ready for the mass adoption.” We seem to have a long way yet to go. Hopefully, not too long.

Watched this video?

Vitalik says, Ethereum’s price will hit $100K when Ethereum 2.0 goes live.

Share your thoughts below.